- About KC Streetcar

- Explore the Route

- How to Ride

- Employment

- News + Meetings

- Advertising & Opportunities

- Streetcar Swag

- RideKC Statement 2.15.2024

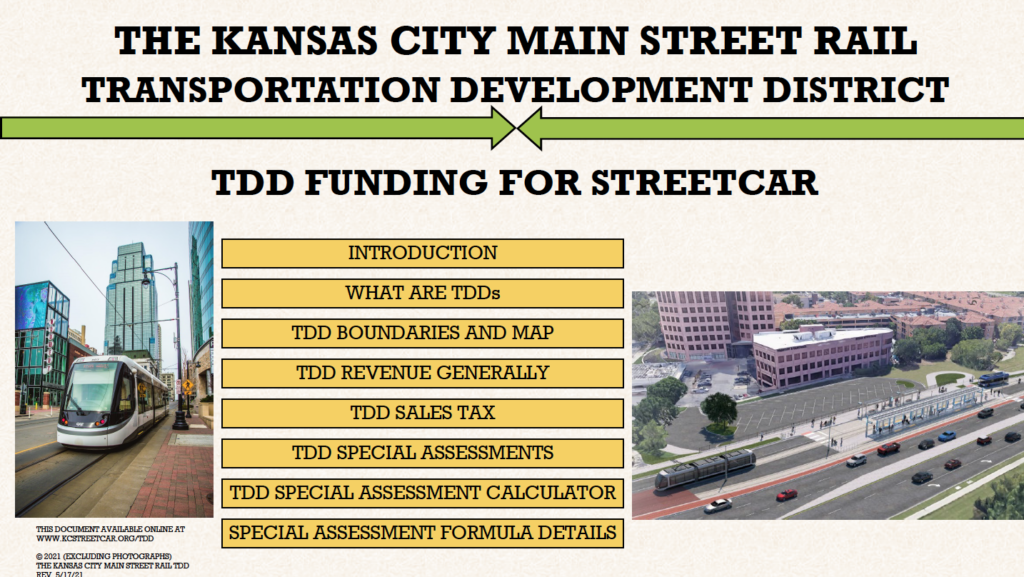

Transportation Development District

Statement from the Main Street Rail TDD regarding recent property assessment notifications | June 21, 2021

Thank you for reaching out to us. We apologize for the erroneous mailing list used for our informational assessment letters. There has been no change to the special assessment zone from the maps that are and have been publicly available at www.kcstreetcar.org/tdd.

The TDD Board has no staff; City staff handled the mailing process for us. We are still investigating and will take corrective actions ASAP. However, please note this was not a bill. It was just intended as advance notice to allow planning for end of year billing since this is the first year of the Main Street Rail TDD’s annual special assessment. We sincerely regret the confusion.

Board of Directors

Kansas City Main Street Rail TDD

MainStreetRailTDD@gmail.com

Click here for more information about the Transportation Development District